tax strategies for high income earners canada

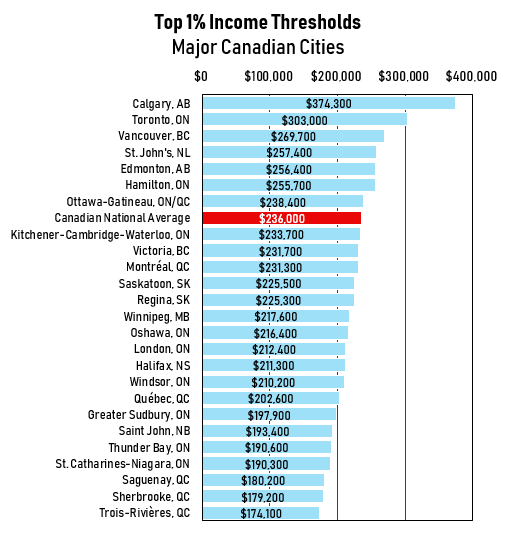

For the nations highest-income earners those making more than 220000 annually the amount. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio.

Helping Businesses Navigate Various International Tax Issues.

. Contact a Fidelity Advisor. High income earners in Canada will benefit immensely from moving their assets being taxed at a higher level into tax sheltered accounts. Learn How EY Can Help.

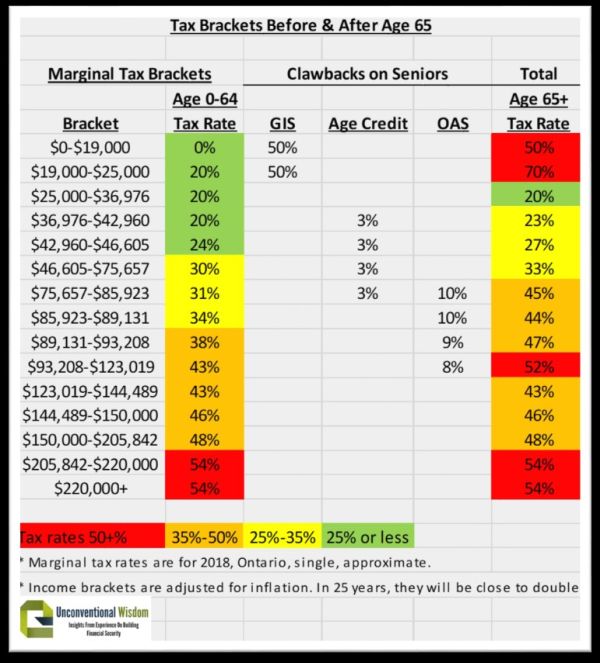

At higher income ranges their Canada Child Benefit has a claw back of 80 of marginal net. With your qualified tax advisor. The more money you make the more taxes you pay.

Registered Retirement Savings Plan RRSP RRSP is a great opportunity for high-income individuals to save on taxes. Ad You Can Do This. Ad Helping Businesses Navigate Various International Tax Issues.

Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article. Contact a Fidelity Advisor. For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep.

Many wealthy Canadians run a side business or their own business for the benefits of lower tax rates business write-offs and tax-deductible individual pension. One such option is the allocation of. You must consider investing in RRSP and make.

Learn How EY Can Help. Additionally tax-deferred accounts benefit by. File With Confidence When You File With TurboTax.

RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. The issue of Canadian Tax loopholes has put a target on privately held domestic corporations in Canada and their uses of business tax rates and personal income tax rates. Ad Browse Discover Thousands of Reference Book Titles for Less.

To prevent passive investment income unrelated to the active nature of the business from being unduly spared from taxation the CRA has put a policy in place that will. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1 million. File Simple Tax Returns Online For Your Max Refund Guaranteed.

A family with two adults and three children will also have a very high tax rate. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. Simplify Your Taxes And Your Life.

The math is simple. Pay Attention to the Medicare Surtax and Net Investment Income Tax for High Earners There are two types of Medicare tax that could be affected by your income level. Either way it is beneficial to take advantage of the tax-reducing benefits of these accounts by contributing maximum income to reduce the tax burden.

Tax minimization strategies for. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities.

Advanced Tax Strategies For High Net Worth Individuals Td Wealth

High Income Earners Need Specialized Advice Investment Executive

How Can A High Income Earner Reduce Taxes In Canada Cubetoronto Com

Tax Planning For High Income Canadians

How Can I Reduce My Taxes In Canada

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

How To Reduce Taxes For High Income Earners In Canada

How To Pay Less Tax In Canada 12 Little Known Tips

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

Tax Planning Strategies For High Income Canadians

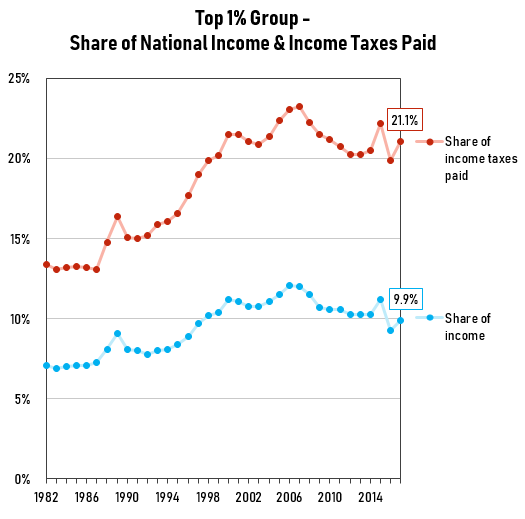

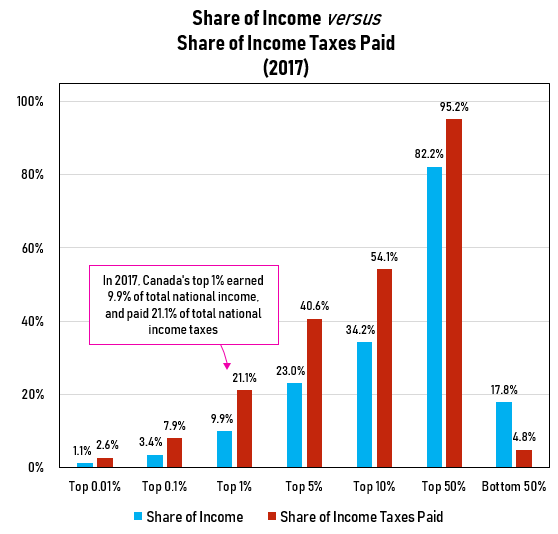

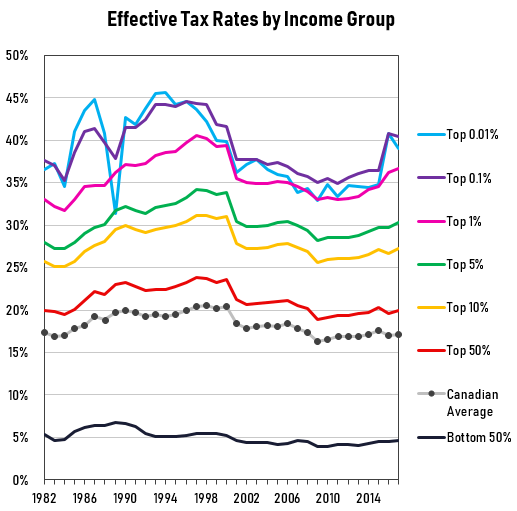

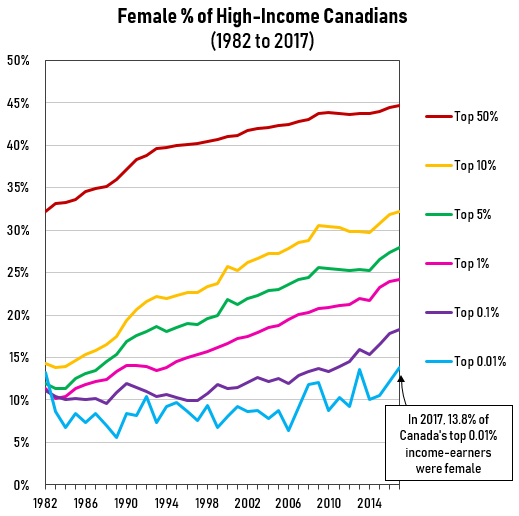

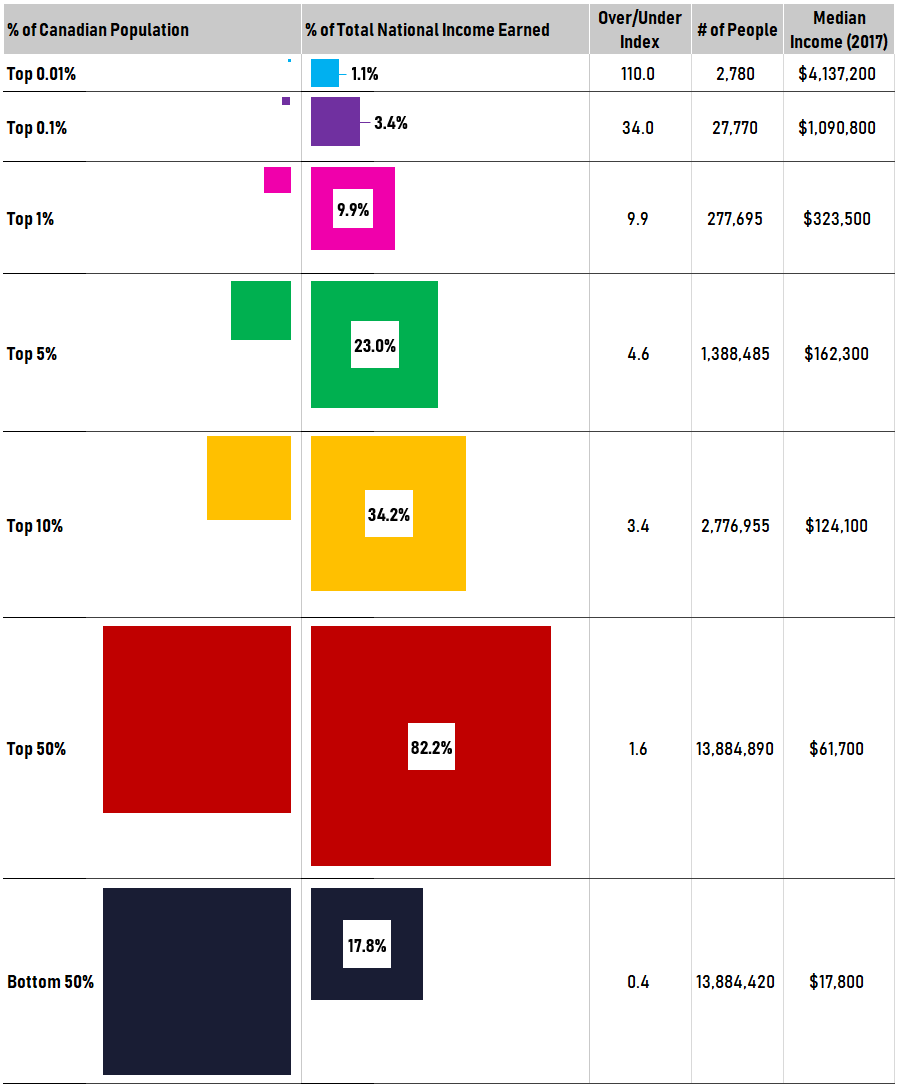

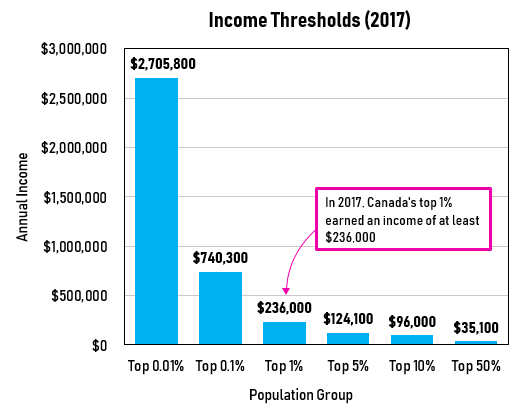

Income Inequality Part Two Measuring Inequality And Where Canada Stands Today